Contact Us & Erin Condren FAQs

We're Ready to Call You!

Online

info@erincondren.com

Your Account

To unsubscribe our emails, click "Unsubscribe" located at the bottom of one of our marketing emails.

To unsubscribe from our text message system, reply "STOP" to one of our text messages on your phone.

Customers are not automatically signed up for EC Insider. If you are an existing

Erin Condren customer, Log onto your ErinCondren.com account and go to the ‘Update

Info’ section within 'My Account'. Scroll down and toggle the Insider Status

to "ACTIVE". To ensure you’ll get all the latest promotions and product

releases, make sure you’re signed up for our newsletter!

For new customers, sign up for an Erin Condren account and make sure you check off

the boxes to participate in the EC Insider rewards program. That’s it! Now

you’ll be earning points and redeeming awards!

Please contact Erin Condren Customer Service to help update your email address.

Photo Uploads

- During cover personalization, scroll down past the name personalization option to the blank photo boxes with the + symbol.

- Click on each box to customize and add a photo.

- Select "Upload Photos", "Or Fill With Color." Please note: If you're logged into your Erin Condren Account and have used our photo upload tool before, you should see those images under the "Local Device" tab.

- Once an image has been uploaded, click on the image to edit the photo and then click "Add Photo To Design".

- The photo will appear on the cover design when it has been successfully added.

For the absolute best print quality for all cover sizes A5, 7x9, and 8.5x11, our designers recommend that photos be 300ppi (think professional photography). Most modern mobile devices, however, are able to shoot great photos.

-Is it at least 1MB to 2MB (megabyte, not kilobyte) in size?

- If you open up your photo on your computer monitor, does it take up most if not all of your screen?

If the answer to both of these question is yes, it’s quite likely that the file will suffice for print.

Photos for covers: For cover photos (like our "Create Your Own" or "Life in Little Squares" design), the full file should be sized as follows:

7x9 Cover: 7 inches by 9 inches (2100 pixels x 2700 pixels).

8.5x11 Cover: 8.8 inches by 11.6 inches (2640 pixels by 3480 pixels).

Designer tip: We want your order to be perfect. Our designers recommend keeping any important art/image elements out of the bleed/trim area to avoid having them cut off.

7x9: After printing and trimming, your final print (before lamination) will be approximately 6.75 inches x 8.75 inches (2025 pixels x 2625 pixels).

8x11: After printing and trimming, your final print (before lamination) will be approximately 8.5 inches x 11 inches (2550 pixels x 3300 pixels).

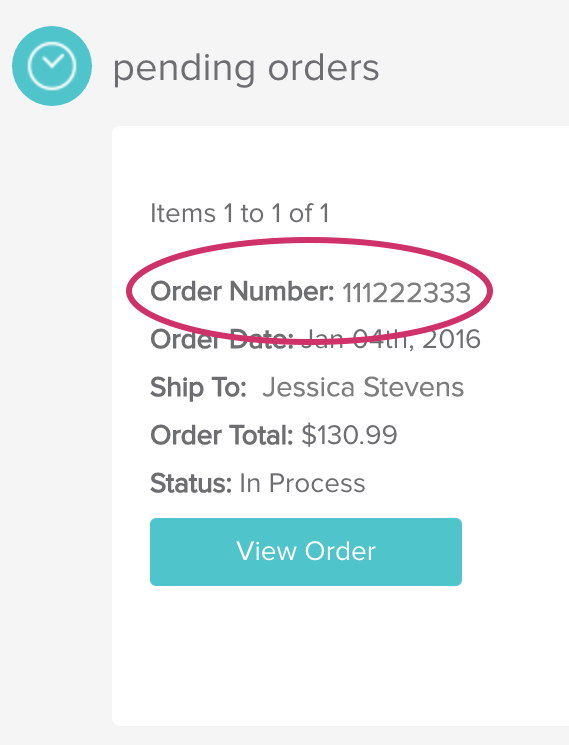

Pending Order

After placing your order, you reach the Thank You page with your order number. Shortly thereafter, you will receive an order confirmation email, which also includes your order number.

- Log in.

- Go to the "My Account" page.

- Scroll down to "Pending Orders".

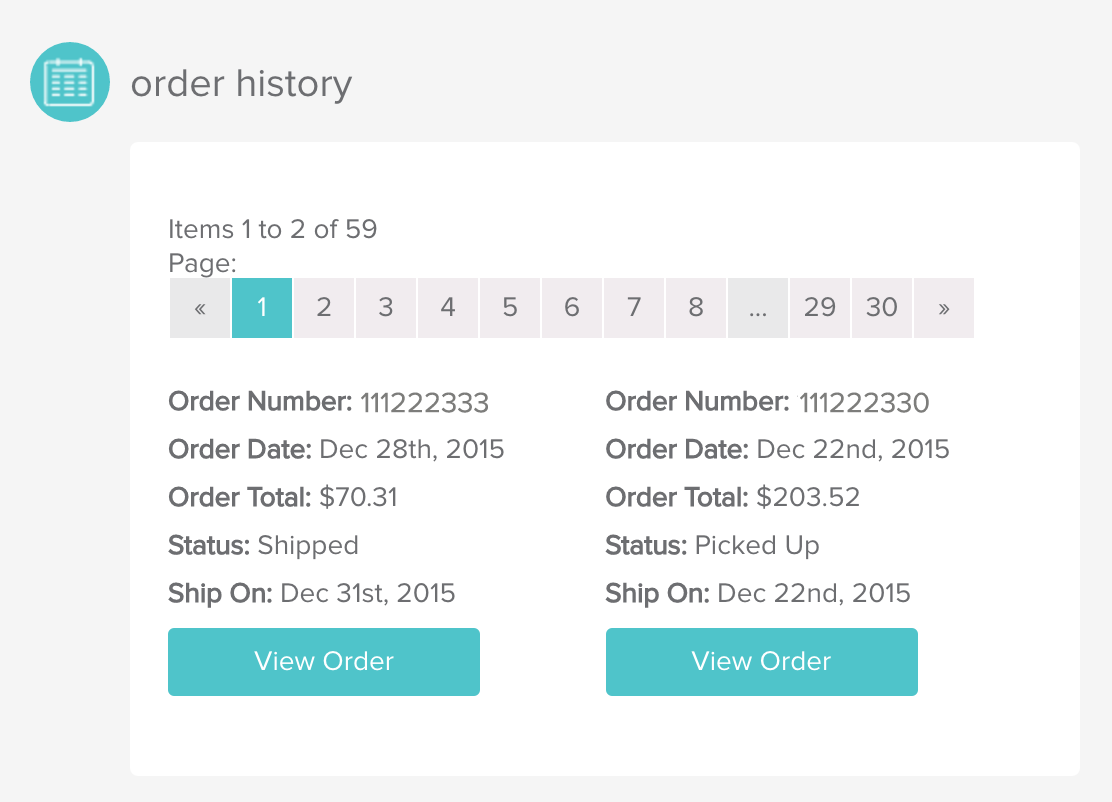

- Log in.

- Go to the "My Account" page.

- Scroll down to "Order History".

Our standard workflow works as follows:

*Standard Items: Order Placed -> In Process -> Shipped

If at any point your item does not meet Erin Condren QA standards, the item remains in "In Process" status.

Payment Pending Oh no! It seems there was an issue with the payment at checkout. Please contact customer service to find out if your order was successful.

In Process We have received your order! Your order is going through the design and production process.

Waiting When an order is placed in "waiting", it simply means that we need some more information from you. More often than not, an order is placed in waiting because the designer is concerned about the quality of your photos.

When your order is placed in "waiting", a CS representative will email you to request the necessary information required to move forward with your order.

In Process Once your beautiful design is completed, it's off to the warehouse to be assembled and packaged with all of the goodies you requested.

Shipped Hooray! Your order is on its way! To view your tracking number, log into your account.

Before you place your order, please review it for accuracy, especially any personalization and customization options. Once you place your order, it cannot be edited, nor can new items be added to a placed order.

To “add” items, please place a second, separate order.

If your order does not arrive within 3-10 business days of its estimated ship date, and you have not received an email with an updated shipping notification, please contact Erin Condren Customer Service.

Every order comes with a cancellation window provided at checkout. You may cancel your order within the given cancellation window, or contact Customer Service for assistance.

Shipping

We are committed to optimizing our customers' shipping experience and work with a variety of carriers — from DHL to FedEx to UPS, USPS, and others — to give customers the most effective shipping vendor for their selected delivery area and preferred shipping speed at the time the order is placed. Rest assured, we're doing everything on our end to get your Erin Condren packages to your door as quickly and efficiently as possible.

All products are processed in our Austin facility. Pickup is not currently an option.

If you just placed your order, please e-mail us with your order number and request the delivery address update. Once your order status is "In Process", we have a tiny window in which we can make the change.

Please keep in mind that once an order has been placed and is in process, there is a small chance we may not be able to update the delivery address. Thank you for understanding!

Most of our orders will ship within 3-6 business days. During peak seasonal times, that window may extend to 7-10 days. We will always provide the most accurate estimated shipping window to you before your order is completed at checkout and make it available to you in your order history for quick reference.

Yes, Erin Condren ships to P.O. boxes. Please select Economy as your shipping method. For APO/DPO and international P.O. boxes, we recommend using a physical address instead to avoid shipping delays.

To track your package, log in to your account to view your order history. Click the "view" button on your order number to view your order status. If your package has shipped, a tracking number will be provided to you.

Expedited shipping refers only to the package's travel time once it’s ready to ship from our shipping dock to your delivery address, not the production process itself. Once your order is placed, it goes through our in-house production process, is packaged with care, and then is finally handed over to our shipping carrier where it goes out via the method you selected.

Most of our orders will ship within 3-6 business days. During peak seasonal times, that window may extend to 7-10 days. We will always provide the most accurate estimated shipping window to you before your order is completed at checkout and make it available to you in your order history for quick reference.

Please visit our Shipping page for details on international shipping fees.

If our system is not accepting your address, please use the suggested address and/or double-check you have the correct address via Google.

Promos & Vouchers

We LOVE to set our customers up with discounts, extra goodies and promotions that are exclusive to members of our website! We encourage all new customers to sign up for EC Insider, our first-ever rewards program before they do anything else. (Find details here) Additionally, we currently offer the "EC Invite a Friend" program, which gives discounts to ALL customers! If you are referred to our site (through a referral link), you receive $10.00 off just for creating an account. After you create the account, you can earn credit just by telling your friends about our company and sharing your referral link with them!

After you set up your account and make your first purchase, you will receive your order with some extra surprises! We love giving our customers extra Erin Condren goodies and rewards-- and we continue to give, give, GIVE as you place more orders.

We formerly offered incentives when you reached 5th and 10th orders. These rewards are not going away, but simply are being folded into our EC Insiders rewards program. Our EC Insiders program rewards you for every purchase, not select purchases so you can receive rewards before hitting benchmarks! The last day to use the existing codes for 5th & 10th orders is September 30th, 2019. We will still honor the reward for your 20th order. To find out about the latest Erin Condren news & promotions, be sure to sign up for our newsletters to get the latest EC Insider emails on sneak peeks, early access, double points & more!

You can view our current promotions here, our current sale items here, and you can get deal alerts sent directly to you via email by signing up here.

Unfortunately, as stated on our website and in our newsletters, all sales and promotions are not applicable towards previously placed orders. The programming for each promotion is created in advance and scheduled automatically to begin at a designated time period. Our marketing team has researched each promotion extensively and decides when to launch and end each promotion, after weighing in various factors.

While we cannot apply promotions to previous orders, we frequently offer new sales and contest giveaways! Are you interested in contests, promos and giveaways? If so, please be sure to sign up for our Newsletter and follow us on social media!

Click here for detailed information on our rewards program!

You can combine EC Insider coupons with EC gift cards & EC referral codes, but please note that it cannot be combined with any promotion codes, including the 15% off first purchase and sign-up coupon code..

Once you have personalized your order and have proceeded to checkout, you will reach the "Payment Information" page. Select either “Use Gift Certificates & Balance” or “Promo or Rewards Code,” then select or manually enter your code, then hit “Apply.” For any remaining balance, your credit card will NOT be charged until you “Confirm Order” on the next screen. For more information on how to earn and redeem EC Insider rewards points, visit your account page and click “Rewards” or visit our EC Insider page.

Credit Vouchers refers to EC store credit that is placed directly on a customer's account as an available balance. Credit Vouchers do not have expiration dates and are applicable towards tax and shipping. Credit Vouchers can be combined with other gift cards, coupons, discounts, and promotions.

How to Access and Use Your Erin Condren Store Credit/Credit Voucher:

- Sign in to your account.

- Shop as usual and proceed to checkout.

- Once you reach the PAYMENT section, click the dropdown for “Use Gift Certificates & Balance.”

- Click the dropdown for “Use Existing Account Balance.” This will reveal your store credit.

- Click “Apply” next to your store credit and proceed to checkout.

Some codes have limitations, so be sure to read the fine print! Certain codes work only for specific products, some codes have a one-time use and all codes have defined expiration dates. Please be sure to read the fine print! Note that all promos exclude bundles, polaroid, eGift Cards, Gift Cards, shipping, taxes & customs fees

Credit Vouchers, eGift Cards and EC Gift Cards can be combined with other gift cards, coupons, discounts, and promotions. Coupon codes generally cannot be combined with other Coupon Codes.

Not at this time; Disney products (including, but not limited to, Star Wars items), are currently ineligible for Erin Condren discounts, promo codes, special offers, and EC Insider rewards, unless specified otherwise.

Yes, we do offer bulk order discounts on select items via individual customer orders over $500 placed directly through our website with code BULK20. Please visit our Corporate Gifting page for more information.

Payment

Yes, unless otherwise indicated, all prices on erincondren.com are USD.

We currently accept Erin Condren gift cards, Visa, MasterCard, American Express, Discover, PayPal, Apple Pay, Amazon Pay, and AfterPay (US customers ONLY).

Please note we do not offer the ability to split payments between multiple payment methods. And some prepaid gift cards may not work if there is no billing address registered due to security measures.

Yes we do!

At ErinCondren.com (“EC”), our customers' privacy and security is our top priority. We take any and all security concerns seriously and investigate each one individually. We continually revamp all of our systems and security processes to ensure state of the art security and monitoring based on the latest technology available. We use industry leading platforms, including Amazon Web Services for website hosting, and PayPal for payment processing, and Alert Logic for network and traffic monitoring. We periodically regenerate all client-side SSL certificates which employ the latest encryption algorithms.

We have performed multiple full-site security audits through external security experts including Trustwave and StratumPoint. There were no issues found related to payment processing or customer data. We have also done thorough reviews of all internal and external payment processes and have found no system or process issues. Our process leverages our trusted payment gateway partner, Authorize.net, to process all credit card transactions. When credit card information is entered on our payments page it is passed directly to Authorize.net through SSL encryption standards, and remains encrypted at all times. At no time do we have direct access to payment information and we do not store ANY customer credit card information on our servers or on any EC databases.

We are committed to continuing to improve the customer experience and protecting customer's privacy. Please let us know if you have any further concerns.

Most of the time this error is caused due to an Address Verification System (AVS) mismatch, meaning the billing address or billing name provided does not match what’s entered at checkout. Please double-check that your billing address and/or billing name matches the card’s information exactly and correct it at checkout. Please note that discrepancies may cause your card to decline. If that happens, your funds will automatically be released within 24-48 hrs.

Donations

We're thrilled to share the incredible impact we've made together through our Heritage and Awareness Months giveback collections, with over $240K donated so far. Your support has truly made a difference, and for that, we thank you!

As part of our commitment to continuously enhance your experience, we've listened to your feedback and are introducing an exciting new way to give back – making it easier and more familiar for you to contribute to causes that matter most to you.

A Simple Way to Make a Big Impact, Together!

Instead of focusing on product-based artist collaborations to support heritage and awareness months, we're shifting gears to empower you to donate effortlessly. Now you can round up your order at checkout, just like you would at the grocery store. It's a seamless process that allows you to support causes close to your heart with a simple click.

Even better, we’ll double your impact by matching your donation. It's a win-win situation – you get to support the causes you care about, and together, we amplify the positive change we can make in the world.

Here’s How It Works

Step 1: Shop as usual for your favorite EC must-haves.

Step 2: During annual heritage and awareness months, you’ll have the option to round up to the nearest dollar at checkout in support of that cause.

Step 3: We’ll match your donation. Win, win!

While giving back will no longer be tied to an artist collection, rest assured that the more direct round-up-at-checkout giveback option will still support our annual heritage and awareness months, including:

- Black History Month (February)

- Asian American Native Hawaiian Pacific Islander Heritage Month (May)

- Pride Month (June)

- Hispanic and Latino/a/e/x Heritage Month (September 15 - October 15)

We're thrilled to see our customers expressing interest in supporting even more diverse heritage and awareness months. As we roll out our new round-up-at-checkout feature with our annual campaigns, we'll gain valuable insights into how we can expand our support for additional causes in the future.

Thank you for being an integral part of our community and for joining us on this exciting journey of making a positive impact together. We're grateful for your continued support.

Afterpay

Afterpay is a service that allows customers the ability to make purchases now and pay them later, in 4 equal installments every two weeks with 0 interest.

Shop on ErinCondren.com and go to check out. At checkout, select Afterpay as your payment option. You will then be directed to the Afterpay website to register and provide payment details there. If you’ve used Afterpay before and have an existing account, just log in. Once logged in, finish completing your order.

Afterpay can only be used on purchases made on ErinCondren.com. It is not available in any of our retail locations.

Afterpay is only available to customers with a U.S. billing address.

All Afterpay customers are required to make the initial payment at the time of purchase. The remaining three payments will be deducted automatically every 2 weeks from the selected payment method. If you want to pay off the balance early, simply log into your Afterpay account and do so. This will then adjust the amount owed and automatically deducted every 2 weeks.

There are no service fees or interest associated with using the Afterpay installment feature. However, if a payment is not paid prior to the due date, you will be responsible for a late fee. View full details here: https://www.afterpay.com/purchase-payment-agreement

Yes. You can use an Erin Condren gift card in conjunction with Afterpay, but you must apply the entirety of your gift card balance. The Afterpay installment amount would be the cart total minus the funds available on your gift card.

To make an Afterpay account, you must be over 18 and a resident of the United States. For full Afterpay terms, click here. https://www.afterpay.com/purchase-payment-agreement

Afterpay orders are delivered with standard shipping timeframes like any other order from ErinCondren. It is not held for any reason because you're using Afterpay.

Afterpay is not available on purchases of subscription products, Seasonal Surprise Boxes, gift cards or e-gift cards. If your order contains one of these items, please purchase that separately.

Afterpay returns follow our standard Erin Condren return process. We cannot provide an exchange or cash refund. Instead, once the refund is processed, the funds will return to your Afterpay account.

Returns & Refunds

We stand behind the quality of our products and want every order to meet your expectations.

- Return window: Items must be returned in new condition within 30 days of delivery.

- Personalized items: These are final sale unless there’s a verified quality control or printing error.

- Damaged or incorrect items: If your order arrives damaged or incorrect, please contact us within 10 days of delivery. We’ll make it right with a reprint or replacement.

- Printing variations: Minor variations may occur during printing and are part of each product’s unique personality — they don’t affect usability or quality.

- Apparel items, bulk orders, corporate gifting, and group sales orders are not eligible for return.

- Refund method: Refunds are issued in the same form of payment used for purchase. If expired/cancelled credit cards, store credit, gift cards, or eGift cards were used, credit will be applied to your account.

- Timing: Refunds can be issued up to 30 days from purchase. After 30 days, store credit will be provided.

We’re here to help! If you have questions or need assistance with your return, reach out anytime at

info@erincondren.com.

We want you to love your purchase! If something isn’t quite right, returns are simple:

- Contact our customer care team to request a prepaid return shipping label via email.

- Print and attach your label, then package your unused items in their original packaging.

- Drop off your package at any post office and track it with your provided tracking number.

- Once received, our team will review your return and process your store credit or refund promptly.

Tip: For faster results, let us know once your package has been dropped off or shows as delivered.

(Some items may not be eligible for return if they’ve been personalized, used, or are not in original packaging. Please report any issues within 30 days of delivery.)

We typically issue refunds within 24-48 business hours of when the returned product is received. However, we have found that it takes 5-10 business days for a refund to reflect in your bank account, depending on your banking institution.

At this time, we do not accept returns on products purchased at third-party retailers. Please contact the customer service department at the retailer where you made your purchase for further assistance.

We have retail stores in Irvine, California, Austin, Texas and our products are sold on Amazon and in select Target, Barnes & Noble, and Container Stores in the US.

Report an issue

If your Erin Condren order is damaged from shipping or may have an error, please contact Customer Service within 10 days of delivery. Depending on the damage, damaged items may be reprinted or replaced with the exact same style item. Please share photos of the damage to help expedite a resolution.

In some cases, minor printing variations may occur that do not affect the usability of an Erin Condren product and are not considered damaged.

When you report an error or e-mail us, the information is submitted to our customer service department and a unique case is generated.

Our Process:

- Customer submits report through website or emails Customer Service directly.

- Information reaches Customer Service Department and a unique case number is generated.

- Our system generates a case number and responds via e-mail to customer, both confirming that we received their information and communicating their case number.

- Cases are addressed by our Customer Service agents individually- case by case.

- Customer Service agents work through the cases.

Please refrain from sending multiple emails regarding the same issue; this duplication will cause us to create multiple cases for the same issue and can cause confusion.

So sorry about that! If you submitted a report/e-mail but did not receive a confirmation e-mail, please submit a new one.

Once you've received a confirmation e-mail with a case number, we will respond to you as soon as we get the chance.

If you submitted a report more than 72 hours ago, received the confirmation e-mail and have not received a response from one of our agents, we apologize.

You can follow up by replying to that same e-mail, which will keep all our communication within the same case/thread. Do not start a new email chain as this will create a different case number.

Technical Issues

We apologize!

- Please try clearing your cache and cookies.

- Please try using a different browser, (specifically we recommend using Google Chrome!)

- Try using a different device or computer.

If you get an error while trying these, please send us a screen shot of the error so that our technical team can easily determine the cause of your issue.

Security & Privacy

Join The Team

Click here for more information.

Contact Information

Our mailing address is:

201 W Howard Ln, Austin, TX 78753

Our business hours are M - F, 9am - 5pm CST, however we do not offer in-store pick ups or tours at this location.

Visit us at our Retail Stores and click each link for store address and hours:

Erin Condren Flagship Store in Austin, Texas

Erin Condren Irvine Spectrum Center Store in Irvine, California

Social & Public Relatio3s

I have aN Erin Condren PR or Blogging request!

Are you planning a special event, speaking engagement or meet-up?

How do I follow Erin Condren on social media?

If you are a blogger or have a press inquiry, please email blogger.relations@erincondren.com along with your subscriber statistics, social channels and any other information that might give us a better understanding of your community. We love working with bloggers!

Please email your request to events@erincondren.com. Be sure to include your website/ social channels, event date, location the type of event you're planning and other details

Let's get social! We can't wait to connect with you! Follow us on TikTok, Instagram, Facebook, YouTube, and Twitter!